BYDDF Versus BYDDY - The Difference Explained

Have you ever found yourself scratching your head, trying to make sense of the two different ways to buy into BYD, that big Chinese electric vehicle maker? You are certainly not alone if you have felt a bit puzzled by the ticker symbols BYDDF and BYDDY. It's a common point of confusion for many who are looking to put their money into a company known for catching the eye of folks like Warren Buffett, who, as a matter of fact, has a stake in this very business.

What makes it a bit tricky, you know, is that both of these symbols point to the same company. It's almost like having two different doors into the same building, but each door has its own set of rules and characteristics. You might see one share price for BYDDF and a different one for BYDDY, which can, in some respects, make you wonder if they are truly for the same thing. This article aims to sort out that exact puzzle for you.

So, we are going to walk through the various aspects that set these two share types apart. We will look at where they are bought and sold, how easily you can trade them, the rules they follow, and even some money matters that might come up. By the end of our chat, you will have a clearer picture of what each share offers, helping you figure out which one might be a better fit for your personal approach to putting money into things.

Table of Contents

- What's the Big Deal with BYDDF and BYDDY?

- Are BYDDF and BYDDY Really the Same Company?

- What's the Key Difference Between BYDDF and BYDDY?

- How Do Prices Show the Difference Between BYDDF and BYDDY?

- What Else Should You Look At When Considering the Difference Between BYDDF and BYDDY?

- Making a Choice - Which BYD Share is Right for You?

What's the Big Deal with BYDDF and BYDDY?

You might be wondering, what's the whole fuss about BYDDF and BYDDY? Well, basically, these are two ways to get a piece of the same company, BYD. This is a very well-known Chinese company that makes electric cars and batteries, and they have been getting a lot of attention, particularly because a really famous investor, Warren Buffett, has put some of his money into it. So, you know, when a name like that gets involved, people tend to pay attention.

The issue, actually, is that when you go to buy shares, you see these two different codes, and it can be a little bit puzzling to figure out which one is the one you should go for. They both represent ownership in BYD, but they are traded in different places and come with their own quirks. It's not like one is better than the other in every single situation; it just depends on what you are looking for as someone putting money into things.

Are BYDDF and BYDDY Really the Same Company?

To be honest, yes, they are. Both BYDDF and BYDDY are ticker symbols for BYD Company Limited. This means that if you buy either one, you are technically owning a piece of the same big Chinese electric vehicle company. It's a bit like buying the same brand of soda, but maybe one is in a can and the other is in a bottle. The drink inside is the same, but the packaging and where you buy it might be different.

- Cho Seung Woo

- How Much Does Drew Carey Make On The Price Is Right

- Camilla Araujo Uncensored Videos

- Courteney Cox Net Worth 2025

- Viral Terabox Link

This is where some of the confusion comes from, naturally. You see two different prices, and maybe even slightly different trading patterns, but they are tied to the exact same business operations and financial health of BYD. So, if BYD, the company, does well, both BYDDF and BYDDY should, in theory, reflect that success over time. It's pretty much just a matter of how you access those shares.

What's the Key Difference Between BYDDF and BYDDY?

The biggest difference, you know, between BYDDF and BYDDY comes down to where you can actually buy and sell them. This is a really important point because the place where a share is traded can affect quite a few things, like how easy it is to buy or sell, how much information is available, and even what rules apply. It's like choosing between shopping at a big, well-known supermarket versus a smaller, local market. Both sell groceries, but the experience is distinct.

Understanding these different trading venues is pretty much the core of figuring out the whole BYDDF versus BYDDY question. Once you get a handle on that, a lot of the other differences, like how much they cost or how they are watched over, start to make a lot more sense. So, let's break down these trading spots and what they mean for you, the person looking to put money into something.

Trading Spots - The Core Difference Between BYDDF and BYDDY

So, here is the main distinction: BYDDF is traded "over the counter," or OTC, in the United States. BYDDY, on the other hand, is listed and traded on the Hong Kong Stock Exchange. These are two very different places to do business, actually, and they operate under different sets of rules and customs. Think of it like buying a car; you can go to a big, established dealership, or you might find one through a private sale. Both get you a car, but the process and guarantees are quite different.

The OTC market, where BYDDF lives, is not a traditional stock exchange like the New York Stock Exchange. Instead, it's a network of brokers and dealers who buy and sell shares directly with each other. This kind of setup, you know, can sometimes mean less public information is readily available, and trades might not happen as quickly as on a major exchange. It's a bit more informal, in a way, which some people might prefer for certain kinds of shares.

BYDDY, being on the Hong Kong Stock Exchange, operates within a more formal and structured environment. This exchange is a major financial hub in Asia, with lots of activity and specific rules for companies that list there. Generally speaking, shares on major exchanges tend to have more people buying and selling them, and there's often more detailed company information that is easy to get your hands on. So, you know, it's a different kind of playing field altogether.

Money Flow - The Difference Between BYDDF and BYDDY's Liquidity

When we talk about "money flow" or "liquidity," we are basically talking about how easy it is to buy or sell shares without causing a big change in their price. This is a pretty important thing to think about. BYDDF, because it trades over the counter, typically has less liquidity compared to BYDDY. What this means, you know, is that there might be fewer buyers and sellers at any given moment for BYDDF shares.

If there are not many people looking to buy or sell, it can be a little harder to get your order filled quickly, or you might have to accept a price that is not exactly what you hoped for. It's like trying to sell a unique item at a small flea market versus a busy online marketplace; you might find a buyer at the flea market, but it could take longer, and the price might be less predictable. BYDDY, being on a major exchange, usually has a lot more people trading it, which tends to make it easier to buy or sell shares at a fair price and pretty quickly, too.

Rules and Watchdogs - The Regulatory Difference Between BYDDF and BYDDY

Every place where shares are traded has a set of rules and people watching over things to make sure everything is fair and proper. This is another area where you will find a distinct difference between BYDDF and BYDDY. Shares traded over the counter, like BYDDF, generally have less strict oversight compared to shares listed on a major exchange like the Hong Kong Stock Exchange. So, you know, the level of scrutiny can vary quite a bit.

For BYDDF, the rules might not require the company to provide as much detailed public information or to follow the same strict reporting guidelines that a company listed on a big exchange would. This can mean that if you are looking at BYDDF, you might have to do a bit more digging to find company updates or financial reports. BYDDY, on the other hand, benefits from the more rigorous reporting and transparency requirements of the Hong Kong Stock Exchange. This means there's usually more public information, and it's often presented in a more standardized way, which can be helpful for people trying to understand the company better. It's basically about how much light is shined on the company's workings.

Tax Considerations - Another Difference Between BYDDF and BYDDY

When you are dealing with shares, especially those traded in different countries, there can be various tax implications that come into play. This is something that you will certainly want to consider when looking at the difference between BYDDF and BYDDY. While I cannot give you specific tax advice, it's worth noting that holding shares traded on a foreign exchange, like the Hong Kong Stock Exchange for BYDDY, can sometimes involve different tax rules regarding dividends or capital gains compared to holding an OTC share like BYDDF. So, you know, it's a good idea to think about how these might affect your personal situation.

These differences could include things like how foreign taxes are handled, whether you can get a credit for them, or if there are different reporting requirements when you do your own taxes. It's pretty much a detail that can add a little bit of complexity, but it's important to be aware of it. Someone who knows a lot about taxes can really help you understand the specific ins and outs for your own circumstances, as tax rules can vary quite a bit depending on where you live and what your situation is.

How Do Prices Show the Difference Between BYDDF and BYDDY?

You might have noticed that the prices for BYDDF and BYDDY are different, like BYDDF at $24.5 and BYDDY at $47.5. This can seem a bit odd since they are for the same company, right? Well, actually, this price difference often comes down to a few things, including the currency they are traded in and the number of shares each symbol represents. BYDDY, being traded in Hong Kong, is priced in Hong Kong Dollars, while BYDDF, traded over the counter in the US, is priced in US Dollars. So, you know, there's a currency conversion at play.

Also, sometimes one share symbol might represent a different number of underlying company shares compared to the other. Even if trading profiles look like "replicas" with similar trading volumes and signals, the actual price per share can be different because of these structural differences in how they are set up for trading in their respective markets. It's like comparing the price of a dozen eggs in one country to the price of a carton of ten eggs in another; the unit of measurement is just a little bit different, which makes the direct comparison tricky without doing some math first.

What Else Should You Look At When Considering the Difference Between BYDDF and BYDDY?

Beyond where they are traded and the rules they follow, there are other aspects you might want to look into when thinking about the difference between BYDDF and BYDDY. It's not just about the trading venue; it's also about how these different listings might influence other parts of the decision-making process. For instance, you know, how they have performed in the past, or what kind of risks they might carry, are also pretty important things to think about.

Considering these other metrics can give you a more complete picture of which option might align better with your overall strategy for putting money into things. It's like picking a car; you don't just look at where it's sold, but also its fuel efficiency, safety ratings, and how much it costs to keep up. So, let's explore a few more of these considerations that can help you make a more informed choice.

Performance and Risk - How BYDDF and BYDDY Stack Up

When you are looking at putting money into shares, you will often want to check how they have performed in the past and what kind of risks they carry. While both BYDDF and BYDDY represent the same company, the specific trading environment can, in a way, influence how their historical performance looks or how their risks are perceived. For instance, less liquidity in an OTC market might mean bigger price swings if a large buy or sell order comes in, which is a kind of risk to think about.

You can compare the historical performance of both, looking at how their prices have moved over time. While they should generally follow the same trend as the underlying company, small differences might appear due to market specific factors. Similarly, when assessing risk, you might consider the additional risks that come with less oversight or lower liquidity, which are more common with OTC shares like BYDDF. BYDDY, being on a major exchange, might offer a slightly different risk profile due to the more structured trading environment. So, you know, it's worth taking a closer look at both.

Other Investment Figures - The Subtle Difference Between BYDDF and BYDDY

There are several other figures that people often look at when deciding where to put their money. These include things like expense ratios, which are fees associated with certain types of investments, or how much the company pays out in dividends, which are payments to shareholders. You might also look at something called the Sharpe ratio, which helps measure how much return you get for the amount of risk you take. While these are often tied to the company itself, the specific listing can sometimes affect how these figures are presented or how easily accessible the information is.

For example, details on expense ratios or dividend payments might be more straightforward to find for a share listed on a major exchange like BYDDY, due to stricter reporting rules. You can also look into fundamental ratings, which assess a company's financial health, and technical ratings, which look at price trends and trading patterns. Comparing these across BYDDF and BYDDY can give you a pretty good idea of which one might fit better with your own approach to putting money into things. It's about getting a full picture, you know, of what each option truly offers.

Making a Choice - Which BYD Share is Right for You?

At the end of the day, deciding between BYDDF and BYDDY really comes down to what you personally prefer and what feels comfortable for you. There is no single "right" answer for everyone. If you are someone who is okay with shares that might not be as easy to buy or sell quickly, and you are comfortable with a bit less direct oversight from official bodies, then BYDDF, the OTC share, might be something you would consider. It's a choice that depends a lot on your personal comfort level with certain characteristics of the market.

On the other hand, if you prefer shares that are generally easier to trade, with more people buying and selling, and where there's a lot of official scrutiny and readily available information, then BYDDY, the Hong Kong-listed share, could be a better fit for you.

【differenceとdifferentの違いを解説】簡単な覚え方や関連表現を紹介 - ネイティブキャンプ英会話ブログ | 英会話の豆知識や情報満載

Differ Definition & Meaning | YourDictionary

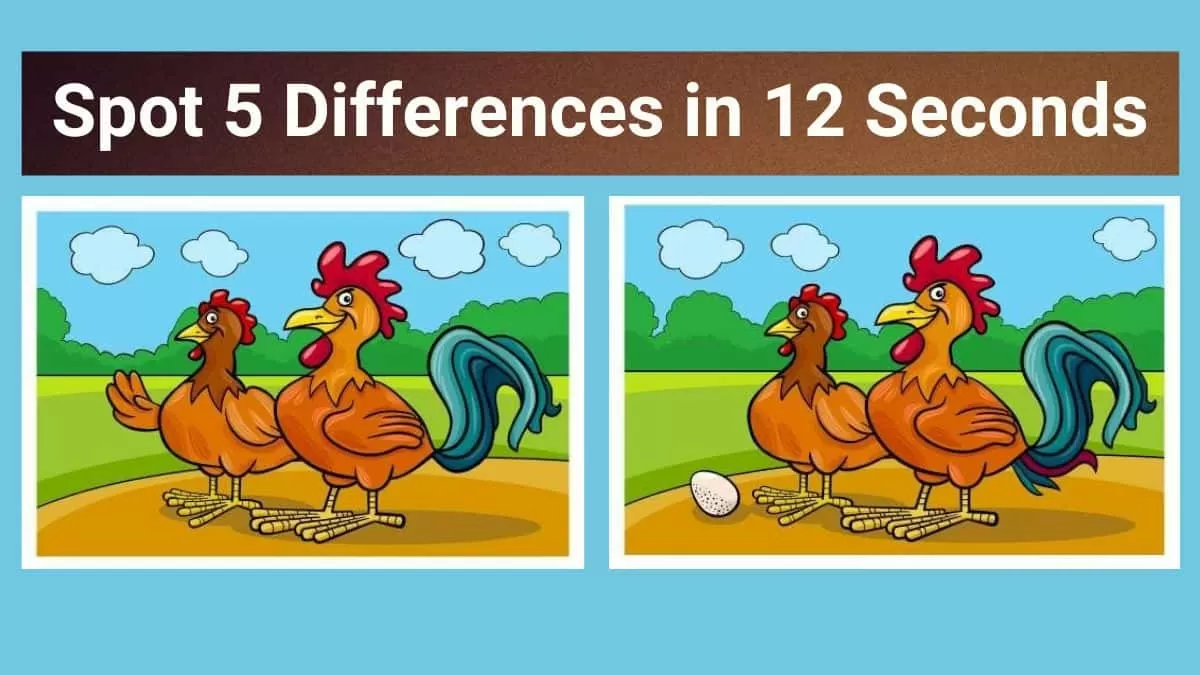

Spot The Difference: Can you spot 5 differences between the two