BYDDF Vs BYDDY - What Is The Difference Between BYDDF And BYDDY Stock?

When someone looks into buying shares of BYD, it can feel a little confusing for some folks trying to figure out the exact difference between BYDDF and BYDDY. You know, these two symbols represent the very same company, BYD, a rather well-known Chinese electric vehicle maker. It is that company, actually, that has even seen investment from a very famous investor, Warren Buffett, which, you know, adds a layer of interest for many.

Many people find themselves asking, what is the difference between BYDDF and BYDDY, especially when they begin to look at the market. Both of these tickers, you see, point to the shares of BYD Company Limited, but they do have some distinct qualities that set them apart. It's almost like having two different doors into the same big house, each offering a slightly different experience once you step inside.

This discussion aims to shed some light on what makes BYDDF and BYDDY distinct, helping you get a clearer picture. We will, you know, look at where they trade, how easy it is to buy and sell them, and what kind of rules they follow. Basically, we want to help you understand these options a bit better so you can make a choice that feels right for you, in a way.

Table of Contents

- What is the difference between BYDDF and BYDDY at a glance?

- Understanding the Trading Venues and what is the difference between BYDDF and BYDDY

- How does trading platform affect what is the difference between BYDDF and BYDDY?

- The Money Side of Things and what is the difference between BYDDF and BYDDY

- What about the money side of what is the difference between BYDDF and BYDDY?

- Considering Regulatory Oversight and what is the difference between BYDDF and BYDDY

- Comparing Performance and what is the difference between BYDDF and BYDDY

- Which One Might Be Right for You - A Summary of what is the difference between BYDDF and BYDDY

What is the difference between BYDDF and BYDDY at a glance?

When you first look at BYDDF and BYDDY, it is easy to feel a bit puzzled, you know? Both of these, as a matter of fact, are ways to own a piece of BYD, that Chinese electric vehicle company. They are, essentially, two different symbols for the same business. The main points where they part ways are how and where they are traded, how easy it is to buy and sell them, the rules they follow, and even some money-related matters, like taxes. It is, basically, about choosing which path feels more comfortable for your own investment style.

One key aspect of what is the difference between BYDDF and BYDDY involves their trading places. BYDDF is something called an OTC stock, which stands for "over-the-counter." This means it is traded directly between parties, not on a big, organized exchange like the New York Stock Exchange. BYDDY, on the other hand, is listed on the Hong Kong Stock Exchange. So, you know, right away, you have two very different trading environments to consider, which can influence how you interact with the shares, actually.

Then there is the question of how much money is moving through these shares. BYDDF, being an OTC stock, might have what people call "lower liquidity." This means it might be a little harder to buy or sell quickly without affecting the price too much, you know. BYDDY, trading on a major exchange, usually sees more activity, which can make it easier to get in and out of your position. This is, definitely, a big part of what is the difference between BYDDF and BYDDY for many people who are thinking about their options.

- %C3%A9%C3%A4%C3%A6

- Rory Gilmore Posture

- Marie Azcona

- Camila Cabello Weight

- How Much Does George Gray Make On The Price Is Right

Understanding the Trading Venues and what is the difference between BYDDF and BYDDY

Let us talk a little more about where these shares are actually bought and sold, because that is a pretty big part of what is the difference between BYDDF and BYDDY. BYDDF, as we mentioned, trades on the OTC market in the United States. This market is a bit different from your typical stock exchange. It is more like a network of brokers who trade directly with each other, rather than through a central platform. This setup can sometimes mean less public information available and, you know, a different kind of trading experience for someone looking to get involved.

BYDDY, on the other hand, is listed on the Hong Kong Stock Exchange. This is a very established and busy market, quite similar in structure to other major global exchanges. When shares are listed on a big exchange like this, they typically have to meet certain rules and reporting standards. This can give investors a sense of, you know, more transparency and a more regulated environment. So, in some respects, the very place these shares call home for trading purposes really highlights what is the difference between BYDDF and BYDDY.

The choice between these two, you know, often comes down to what you are comfortable with. If you are someone who feels okay with a less formal trading environment and perhaps less strict oversight, then BYDDF might seem like an option. But if you prefer the structure and rules of a major international exchange, then BYDDY would, you know, probably feel more like your kind of thing. It is, essentially, about personal preference for the trading landscape, which is a key part of what is the difference between BYDDF and BYDDY for many folks.

How does trading platform affect what is the difference between BYDDF and BYDDY?

The platform where a stock trades has a real impact on how you interact with it, and this is a central point in what is the difference between BYDDF and BYDDY. For BYDDF, being an OTC stock, you might find that not all brokerage firms offer easy access to it. Some brokers might have specific requirements or higher fees for trading OTC securities. It is not always as straightforward as buying a stock listed on a major exchange, you know. This can add a layer of complexity for someone new to this kind of trading.

BYDDY, being on the Hong Kong Stock Exchange, usually means it is more accessible through international brokerage accounts. Many larger brokers offer direct access to foreign exchanges, making it relatively simple to buy and sell these shares. The process tends to be more standardized, and you often have more tools and information available through your trading platform. So, you know, the actual buying and selling experience itself is a notable part of what is the difference between BYDDF and BYDDY.

It is worth thinking about how convenient it feels to trade each one. If you are already used to dealing with foreign stocks or have a brokerage account that supports international trading, BYDDY might feel more convenient. If you are sticking to a more traditional U.S.-based setup and do not mind a bit more legwork for less common shares, then BYDDF could be an option. This element of convenience, basically, is a pretty important part of what is the difference between BYDDF and BYDDY for many people.

The Money Side of Things and what is the difference between BYDDF and BYDDY

Let us talk about the financial aspects, because that is where what is the difference between BYDDF and BYDDY really starts to matter for your wallet. One thing to consider is the actual price you see. The provided text mentions that BYDDF trades at an HKD:USD conversion rate (0.13) of the Hong Kong shares, which makes financial breakdowns in USD easier. BYDDY, on the other hand, trades at 2x BYDDF. This pricing difference is, you know, quite important to grasp when you are comparing them.

This pricing structure means that while both represent the same company, the actual cost per share will be different. You might be buying a different number of shares to get the same overall value, depending on which ticker you choose. It is, basically, about how the underlying value is presented in the share price. This can, obviously, affect how you plan your investment amount and what kind of budget you need for each option, so that is definitely a part of what is the difference between BYDDF and BYDDY.

Beyond the direct share price, there are other money-related things to think about, like how easily you can turn your shares into cash. This is what people call "liquidity." BYDDF, being an OTC stock, sometimes has lower liquidity. This means that if you want to sell your shares quickly, you might have to accept a slightly lower price, or it might take longer to find a buyer. BYDDY, trading on a busy exchange, typically has higher liquidity, making it easier to buy and sell without much fuss. This practical aspect of how quickly you can move your money is, you know, a very real part of what is the difference between BYDDF and BYDDY.

What about the money side of what is the difference between BYDDF and BYDDY?

When we dig deeper into the money aspects, we also need to consider things like historical performance, how much risk is involved, expense ratios, dividends, and even something called the Sharpe ratio. These are all things that can help you figure out which asset, you know, aligns better with your personal financial approach. It is not just about the current price, but how it has behaved over time and what kind of returns it has offered relative to its risk. This is, in some respects, a very comprehensive way to look at what is the difference between BYDDF and BYDDY.

For example, looking at dividends, one version might have a different dividend payout or schedule compared to the other, even if they are for the same company. This could be due to the specific structure of how the shares are offered in different markets. So, if you are someone who values receiving regular income from your investments, then, you know, understanding the dividend policy for each ticker is pretty important. This income potential is, basically, a significant part of what is the difference between BYDDF and BYDDY for many income-focused investors.

Then there is the topic of taxes. Depending on where you live and which ticker you buy, the tax implications can be quite different. Investing in an OTC stock versus a stock on a foreign exchange can trigger different tax rules regarding capital gains, dividends, and even currency conversions. It is, honestly, something you would want to look into with a tax professional to make sure you are making the most informed choice. These tax considerations are, without a doubt, a crucial part of what is the difference between BYDDF and BYDDY for many people.

Considering Regulatory Oversight and what is the difference between BYDDF and BYDDY

The level of regulatory oversight is a very important factor when thinking about what is the difference between BYDDF and BYDDY. OTC stocks, like BYDDF, generally operate with less regulatory scrutiny compared to shares listed on major exchanges. This means there might be fewer public reporting requirements or less strict rules about how information is shared with investors. For some, this might feel like less protection, you know, or less transparency.

Shares listed on the Hong Kong Stock Exchange, like BYDDY, are subject to the rules and regulations of that exchange and the local financial authorities. These rules are often quite strict and aim to protect investors by ensuring companies provide regular, detailed financial reports and adhere to certain standards of conduct. This difference in oversight can, basically, give investors a different level of comfort regarding the information they receive and the overall fairness of the market, which is a key part of what is the difference between BYDDF and BYDDY.

If you are someone who prefers to invest in environments with a high degree of regulatory supervision and clear rules, then BYDDY might feel like a more secure option. If you are comfortable with a bit more flexibility and less formal oversight, then BYDDF could be something you consider. It is, essentially, about your personal comfort level with how much a market is watched over by official bodies. This aspect of supervision is, definitely, a major part of what is the difference between BYDDF and BYDDY for many people.

Comparing Performance and what is the difference between BYDDF and BYDDY

When you are looking at what is the difference between BYDDF and BYDDY, it is also worth comparing their performance over time. While both represent the same company, their individual trading environments and the way they are priced can lead to slightly different historical returns. You can look at charts and data to see how each one has performed in the past, including things like price movements and overall gains or losses. This can give you a better sense of how they behave, you know, in the market.

Beyond just looking at past prices, people also consider "fundamental" and "technical" ratings for each. Fundamental ratings look at the company's financial health, like its sales, profits, and debt. Technical ratings, on the other hand, look at price patterns and trading volumes to predict future movements. Comparing these ratings for both BYDDF and BYDDY can give you a more complete picture of their potential, you know, as an investment. This analytical comparison is, basically, a very detailed part of what is the difference between BYDDF and BYDDY.

It is important to remember that past performance does not guarantee future results, but looking at these metrics can help you understand the characteristics of each ticker. You might find that one has been more volatile, meaning its price swings up and down more, or that one has consistently offered higher dividends. These subtle differences in how they have behaved can, in some respects, guide your decision about which one fits your own investment goals. This detailed look at their track record is, without a doubt, a crucial part of what is the difference between BYDDF and BYDDY.

Is one really better when considering what is the difference between BYDDF and BYDDY?

The question of whether one is "better" than the other when considering what is the difference between BYDDF and BYDDY is, honestly, something that depends entirely on you. There is no single answer that fits everyone. What works for one person might not work for another, given their unique preferences for things like how easy it is to buy and sell, how convenient the trading process feels, and what kind of regulatory environment they are comfortable with. It is, basically, about aligning the investment with your personal comfort zone.

For instance, if you are someone who prioritizes having a lot of options to buy and sell quickly and you prefer the structure of a major, well-regulated exchange, then BYDDY might be the one that appeals more to you. The Hong Kong Stock Exchange offers that kind of environment, you know. It is often seen as a more traditional route for international investing, and many people feel a sense of security there.

However, if you are comfortable with potentially lower liquidity and a less strict regulatory environment, and perhaps you are looking for a different kind of trading experience, then BYDDF, as an OTC stock, might be worth considering. Some investors are, in a way, drawn to the unique characteristics of the over-the-counter market. So, you know, the "better" choice really comes down to your own investment philosophy and what you prioritize when putting your money to work.

Which One Might Be Right for You - A Summary of what is the difference between BYDDF and BYDDY

To sum things up, when you are trying to figure out what is the difference between BYDDF and BYDDY, it really boils down to a few key areas. Both symbols let you own a piece of BYD, the Chinese electric vehicle company that Warren Buffett, you know, has invested in. But they trade in different places, which affects how you buy and sell them, and how much oversight they have. BYDDF is an OTC stock, meaning it is traded over-the-counter, often with less liquidity and different regulatory rules. BYDDY, on the other hand, is listed on the Hong Kong Stock Exchange, which typically means more trading activity and stricter oversight.

The choice between BYDDF and BYDDY, essentially, comes down to your own comfort level. If you prefer a trading environment with more activity and established rules, BYDDY might be a better fit. If you are okay with less active trading and a different set of regulations, BYDDF could be an option. You also need to think about the financial details, like how the prices compare, potential dividends, and the tax implications for each. These are all pretty important parts of what is the difference between BYDDF and BYDDY.

Ultimately, you know, comparing these two options means looking at things like their past performance, the risks involved, and even how easy it is to manage them within your investment portfolio. It is about finding the one that truly aligns with your personal investment style and what you hope to achieve. So, basically, understanding these distinct characteristics is key to making a choice that feels right for you, when considering what is the difference between BYDDF and BYDDY.

- Who Is Mama May On The Price Is Right

- Kyler Murray Wife

- Jayshree Gaikwad Web Series Online

- Secret Therapy Leaks

- Shuba Sree Leaked Video

【differenceとdifferentの違いを解説】簡単な覚え方や関連表現を紹介 - ネイティブキャンプ英会話ブログ | 英会話の豆知識や情報満載

Differ Definition & Meaning | YourDictionary

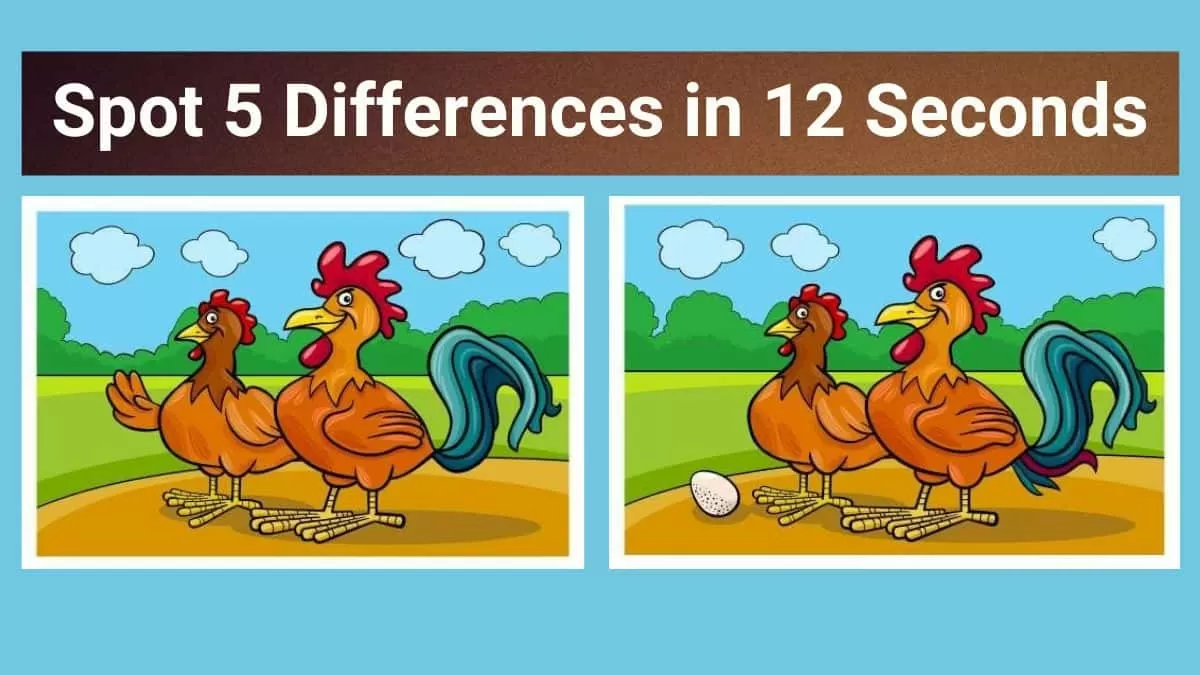

Spot The Difference: Can you spot 5 differences between the two